Homes as Essential Infrastructure

Canadian Deputy Minister Paul Halucha on Why Modular Must Power Canada’s Housing Reset

The housing crisis is nothing new. Across the world, federal, state, and municipal governments of all sizes are struggling with how to provide more affordable housing—quickly—to those who need it.

In Canada, Paul Halucha, Deputy Minister of Housing, Infrastructure, and Communities Canada (HICC), argues that the federal role in housing has shifted from funding at arm’s length to actively shaping outcomes.

“We are seeing a shift from passive to a more directed investment in infrastructure, with the federal government setting policy outcomes and assessing projects based on merit. Much more of an informed investor,” said Halucha.

“And on housing, the federal government has clearly ramped up its presence to influence outcomes on housing policy. Establishing a federal housing department –HICC–and the current government commitment to establish a new federal agency are strong indications that housing has become an important federal priority.”

That federal focus, he stresses, depends on teamwork. “Collaboration with our municipal, provincial, territorial, and Indigenous counterparts has been, and will continue to be, critical in this effort.”

Paul Halucha, Deputy Minister of Housing, Infrastructure, and Communities Canada (HICC).

A Tough Market, and a Long Climb Back

Halucha does not sugarcoat the current landscape. “It is clearly a very challenging market, for a host of reasons – high rates of population growth, rising cost of construction, rising costs of housing, supply not having kept up with demand,” he said. “We Canadians find ourselves with a structural imbalance and this will take years to correct. It will require a lot of change, such as productivity improvements in the housing sector to drive down costs and the addition of a lot of new sustained supply being added.”

The crunch, he notes, has hit both owners and renters, and it has been compounded by pandemic aftershocks and trade tensions that builders feel every day.

With that backdrop, the mission is straightforward, if not simple. “The bottom line is that we need homes to become more affordable, and we need to add additional supply. That is the task at hand,” Halucha said. “Canada Mortgage and Housing Corporation (CMHC) housing research highlights the scale of the supply challenges that Canada is facing, and the importance of pulling every lever we have to build more homes and build them quickly. The Government of Canada will use every tool at its disposal to boost Canada’s housing supply and double the pace of construction.”

To steer that effort, HICC is drawing on a broad evidence base. “The department receives extensive data and information on what is happening in the marketplace in Canada,” he said. “We receive information from a wide range of sources, including Statistics Canada, CMHC, Real Estate Associations, builders, industry groups, developers, non-profit organizations, and banks. Many firms are very generous in providing detailed information what is happening in the market. Taken together, these sources provide us with a very detailed understanding of what is happening in the market.”

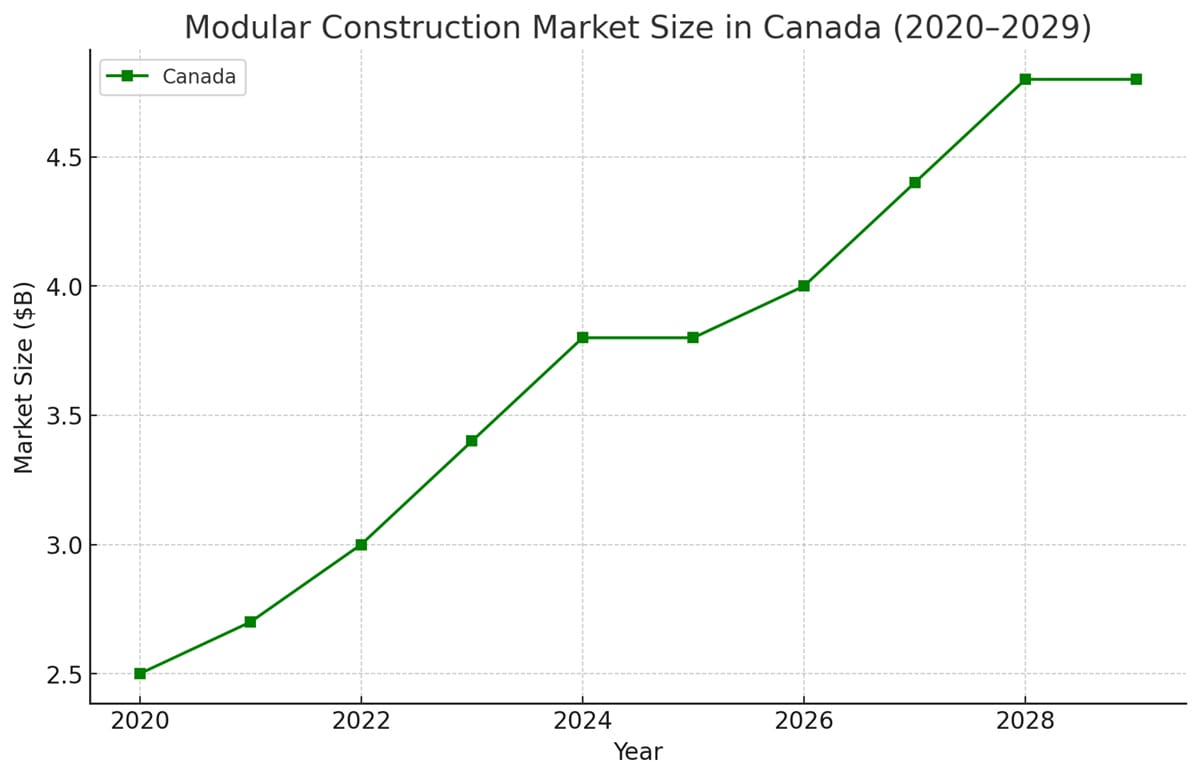

MBI’s 2025 Canadian Modular Construction Industry Report projects significant modular market growth in Canada over the next few years.

Why Modular, and Why Now

Halucha places modular and offsite construction at the center of Canada’s productivity push. “I think the transition to wider adaption of industry methods and application of technology to home building is fundamental to raising productivity, accelerating the pace of construction and lowering costs,” he said. “The Prime Minister has talked specifically on the need to transform the sector, and I also think that is key and needs to be at the core of federal efforts.”

He argues that the current imbalance should catalyze innovation, competition, and new entrants. “Economics tells us that structural imbalances like the one we have now should attract new entrants into markets and innovation through the introduction of new technologies and new ways of doing things. That is precisely what we need to see happen in homebuilding. More competition – I don’t just mean from new firms and builders, but also through application of technology and new building methods. There are a lot of impressive companies entering this space now.”

In that push, modular offers speed, scale, and adaptability. “The modular housing sector will play a key role in increasing housing construction on the scale that Canada needs,” Halucha said. “Finding and leveraging affordable, Canadian-made solutions to the challenges that homebuilders may face in their projects will be critical to building more homes, faster.”

And beyond capacity, modular housing technologies bring practical advantages when projects hit the field: “These techniques can allow builders to adapt quickly and flexibly to many of the logistical and operational challenges that might affect large construction projects during on-site assembly.”

The Financing Reality

Halucha is blunt about what stops projects cold. “A very wise and established home builder told me early on that this sector is as much about financing as it is about building. Everything I have learned since has validated this point. If the financing underpinning a pro forma does not work, then that is it; stuff won’t be built,” he said. “The tariffs have clearly created a lot of uncertainty and that has an impact on consumer sentiment. This is true of overall markets but has hit housing hard, as obviously homes are a major purchase for families.”

The demand side is shifting, too. “There is also strong reason to believe that in some markets, the price of homes has outdistanced the willingness and ability of people to pay the prices being sought by sellers. Rents going down, vacancies increasing for many months in a row, is creating a buyer’s market and many buyers are waiting to see where prices will go. Hopefully market actors respond by reducing costs through innovation. That would be the best outcome.”

Cutting Friction Upstream

One lever to compress time and cost lies in design and approvals. “The Housing Design Catalogue is currently online. The technical design packages for rowhouses, fourplexes, and sixplexes will be shared in the coming months,” Halucha said. “Ultimately, the goal with the Catalogue is to make every effort to reduce friction and timing delays in the design and permitting stages of home building. The intent is to help builders and communities in Canada finish approvals and build homes faster.”

Partnerships, Programs, and Pipeline

Halucha points to an emerging federal platform to coordinate activity. “Work is underway to establish Build Canada Homes, a core government priority,” he said. “More details on its implementation will be available at a later date, but we will be looking forward to leveraging this new initiative as we deepen our collaboration with the modular housing sector.”

Momentum is building, he adds: “I’m encouraged by the level of interest from the industry and level of engagement so far.”

Supply Chains, Tariffs, and Skills

On the industrial backbone that modular depends on, the department is coordinating with partners across governments.

“In response to U.S. tariffs and ongoing trade negotiations, the government is focused on supporting Canadian workers. I would point to the Prime Minister’s recent announcements on protecting and strengthening Canada’s steel and lumber industries as examples of how the federal government is investing in the Canadian workforce,” Halucha said. “In terms of impacts of tariffs on homebuilding and the construction sector, HICC has established a network with provinces to share relevant information. On the availability of critical inputs, the department is providing this data to trade and finance officials who directly manage our tariff countermeasures.”

Measuring What Matters

Halucha says the near-term scoreboard is simple, and it aligns with modular’s strengths.

“HICC is currently developing a path forward for Build Canada Homes that delivers the priorities outlined in the Speech from the Throne and taps into the innovation opportunities in the home building sector. This is a key priority for the Minister and the department,” he said. “In terms of key performance indicators, we will be focused on increasing the speed of new construction and the number of housing starts and completions, and on growing the growing number of affordable houses available to Canadians.”

What to Expect in the Next 6–12 Months

“HICC will continue to engage with the modular and prefabricated construction industry on the development of Build Canada Homes, and we will be looking for industry to find opportunities to scale and link to other projects that Build Canada Homes will receive,” Halucha said. “We will be able to share additional information, including on potential partnership and collaboration opportunities, eligibility requirements, and applications processes, as it becomes available.”

A Strategic Sector, and a Personal Conviction

Halucha’s enthusiasm for off-site construction is both institutional and personal. “I would say without a doubt that we are excited by the potential in off-site construction and the modular housing industry. As we look to spur economic resilience and growth, we need to think of the home-building sector as a strategic industrial sector and homes as essential infrastructure.”

And he has seen that potential up close: “I have personally had the great opportunity throughout my career to work with great Canadian innovators and visit their factories. It is a really exciting time to be working on this issue.”

About the Author: John McMullen, PCM, is the marketing director for the Modular Building Institute. You can reach him directly at mcmullen@modular.org or on LinkedIn.

More from Modular Advantage

How Stack Modular Is Using AI to De-Risk Mid- to High-Rise Modular Construction

Artificial intelligence is no longer a future concept in modular construction—it is already reshaping how complex buildings are evaluated, designed, and delivered.

Gearing Up for the 2026 World of Modular

The Modular Building Institute (MBI) is bringing its global World of Modular (WOM) conference and tradeshow back to Las Vegas in April, and with it comes some of the industry’s best opportunities for networking, business development, and education.

New High-Rise Modular Apartment in Abu Dhabi Points Toward the Future of Multifamily Construction

Eagle Hills International Properties chose the BROAD Holon Building for a 16-story market rate apartment building in Zayed City, a central business district of Abu Dhabi. The project highlights the potential of the Holon system of volumetric modular construction to accelerate housing delivery.

MBI Announces First Ever Industry Apprenticeship Program in Collaboration with Marshall Advanced Manufacturing Center

MBI recently agreed to partner with Marshall Advanced Manufacturing Center (MAMC) to provide bona fide USDOL-approved apprenticeship programs for the industry.

AoRa Development Aims for New York’s First Triple Net Zero Building Using Modular Methods

More cities are providing funding for newer infrastructure projects as long as they meet sustainability requirements. This is how modular can fit the bill, thanks to its lower waste production.

Developers and Designers: Lessons Learned with Modular Design

Modular construction is attractive to many developers because sitework and module construction can occur simultaneously, shortening the schedule and reducing additional costs.

UTILE: Putting Modular Building on a Fast Track

In Quebec, UTILE is taking the lead in creating affordable modular buildings to help decrease the student housing shortage. During the process, the company discovered what it takes to make the transition to modular building a success.

Sobha Modular Teaches Developers How to Think Like Manufacturers

With its 2.7 million square foot factory in UAE, Sobha Modular is bringing both its high-end bathroom pods to high-end residences to Dubai while developing modular projects for the U.S. and Australia.

RoadMasters: Why Early Transport Planning is Make-or-Break in Modular Construction

In modular construction, transportation is often called the “missing link.” While it rarely stops a project outright, poor planning can trigger costly delays, rerouting, and budget overruns.

Navigating Risk in Commercial Real Estate and Modular Construction: Insights from a 44-Year Industry Veteran

Modular projects involve manufacturing, transportation, and on-site assembly. Developers must understand exactly what they are responsible for versus what they subcontract. Risk advisors should research the developer’s contractors, subcontractors, and design-build consultants—especially the modular manufacturer.