Navigating Risk in Commercial Real Estate and Modular Construction: Insights from a 44-Year Industry Veteran

A Legacy in Risk Management

Daniel Seltzer’s grandfather and father founded a risk management/insurance brokerage in Philadelphia in the 1920s, establishing the foundation for what would become his lifelong career. Over the span of 44 years, he’s built a distinguished path in insurance and risk advising, holding the CPCU.

Early in his career, Seltzer gained early underwriting experience during eighteen months “running slips” at Lloyd’s of London. He later returned to the family firm, where he climbed to President and CEO before its sale in 2013, and continued his career with a respected company in the field. Eighteen months ago, he joined RCM&D—a firm he has admired since childhood. For Seltzer, it was coming home again.

Founded in 1885, RCM&D (platform company of Unison Risk Advisors), employs roughly 1,600 people, all of whom share ownership in the privately controlled company.

Defining the Management of Risk in Real Estate Development

Seltzer categorizes real estate development risk into three primary types:

- Stabilized Assets – Completed buildings where operational risk management is key, such as ensuring protective systems—sprinklers, surveillance, and life-safety components—are functioning properly.

- Development Projects – Buildings under construction, where well-crafted insurance programs and strong indemnification requirements for general contractors and subcontractors are essential, including optimal Additional Insured endorsements and precise contractual language.

- Corporate Risk – Directors and Officers or General Partnership Liability, requiring careful evaluation of exposures and selection of appropriate limits and retentions to protect the balance sheet.

Modular vs. Traditional Construction: A Risk Perspective

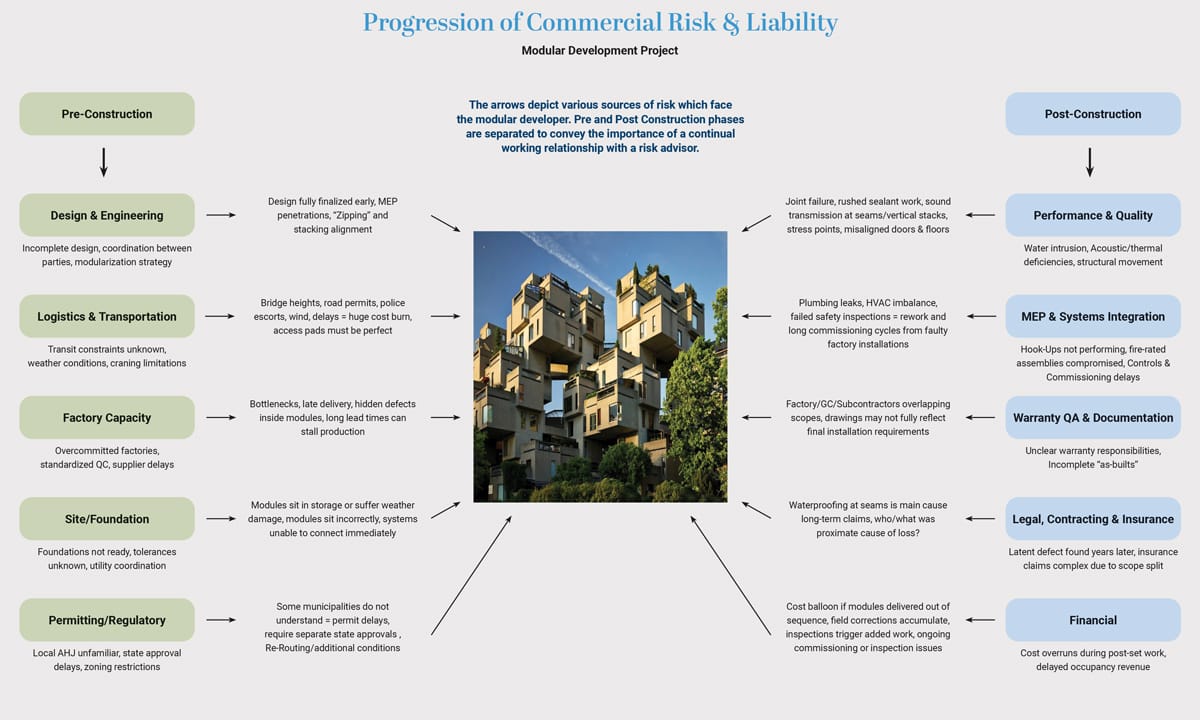

Seltzer explains that although modular construction differs quite a bit from traditional projects, the risk management process itself does not change. “Step one, risk identification, followed by quantifying the range of financial impact of such risk. The advisor must then recommend the method(s) for managing risk,” he says.

The five fundamental strategies remain: avoidance, reduction, control, transfer, and assumption. Where modular and traditional construction diverge is in the type and intensity of certain risks.

Risks Modular Construction Reduces

Modular construction shortens the period of outdoor work which significantly reduces:

- Public and worker injury risk

- Weather-related damage

- Construction defect likelihood, due in part to more robust upfront engineering

Risks Modular Construction Amplifies

At the same time, modular introduces unique and amplified risks:

- Transportation risk– Usually, more parties are involved in the development, transit logistics are more complex, and storage and/or consolidation points increase. The risk advisor should assess the values and various parties in the mix, study the Gantt/CPM, and make recommendations to the developer.

- “Zipping” risk– The on-site joining of modular units—creates a sequencing risk unique to modular builds.

Why Modularity Challenges Insurers

Seltzer calls modular construction a “relative newcomer” to insurers because the industry lacks the actuarial history needed for accurate pricing. Until modular generates enough credible loss data, carriers often blend its results with traditional construction.

To illustrate the insurance challenge, Seltzer poses a thought-provoking comparison: “In what other industry does the provider of the product or service not know their ultimate costs until years after the sale is made? Insurance carriers do not know their costs until years after the premium is charged.”

Still, he stresses that insurance for modular construction is readily available. The issue is not accessibility but accuracy of long-term modeling.

Mapping Risk Across Modular Project Phases

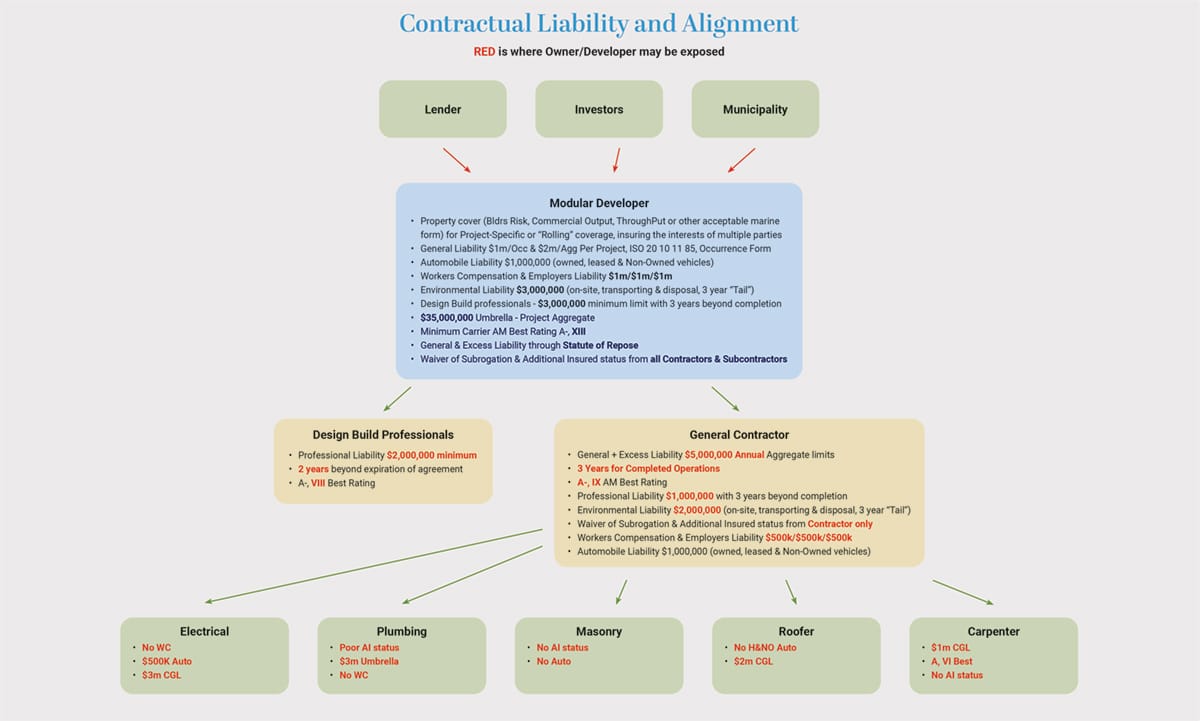

Modular projects involve manufacturing, transportation, and on-site assembly. Developers must understand exactly what they are responsible for versus what they subcontract. Risk advisors should research the developer’s contractors, subcontractors, and design-build consultants—especially the modular manufacturer.

“If my client is a developer and they’re going to hire A-B-C manufacturer, it's very important to research that firm to help assess what the risk is,” Seltzer explains.

The Top Three Risk Pitfalls for Modular Developers

- Underinvesting Time in Risk Planning – Developers often under-allocate time to the risk management process.

- Errors & Omissions (Professional Liability) Risk – Modular projects involve many consultants. Developers commonly require these partners to carry professional liability insurance, but Seltzer recommends an additional layer be considered: OPPI (Owner’s Protective Professional Indemnity) coverage.

- Disjointed Property Insurance – Modular projects include multiple risk locations: manufacturing facilities, transit routes, temporary storage, project-site staging areas, and installation zones. Seltzer strongly recommends a single inland marine policy, covering transit, off-site storage, temporary housing, and builder’s risk under one program.

Choosing the Right Broker

With over 35,000 insurance brokers in the U.S., Seltzer suggests a deliberate and thorough process in advance of hiring your risk advisor, similar to that of a doctor and tax advisor. He emphasizes that the right broker should:

- Arrive prepared and ask insightful questions

- Review all contracts

- Visit the project site

- Produce professional-quality submissions

- Understand modular construction deeply

“A broker who does not meet these criteria may leave the developer with gaps revealed only when it’s too late,” he cautions.

For Seltzer, transparency isn’t a courtesy—it’s a safeguard. “Developers should always see exactly what the broker submits to the market and the underwriters’ written responses,” he says. This level of visibility is rare but essential, as a single omitted detail can cascade into costly exposures.

Business Interruption and Real Loss Scenarios

Seltzer distinguishes between Loss of Income, which covers the loss of net income and continuing expenses, and Extra Expense, which covers the post-loss incremental increase of costs required to minimize loss. “Coverage must reflect the actual project architecture, supply chain, and lender requirements—not a generic template,” he says, offering real scenarios he sees often to illustrate the stakes, including:

- Flood at the manufacturing plant destroys modules, causing a two-month delay.

- Fire two weeks before the issuance of the Certificate of Occupancy halts progress and increases interest expenses.

Trucking consolidation turns a $50,000-per-truck exposure into $400,000 in one location.

Professional Liability: Retroactive Dates and Project vs. Practice Policies

Seltzer demystifies Claims Made Professional Liability insurance: a retroactive date defines how far back claims-made coverage applies. “For example, May 1st, 2018 - a $1 million limit applies to all projects since that date—not a single customer and not a single year. Most policies are Practice-based, covering the consultant’s entire practice, while Per-Project policies are not seen as often and are more expensive, though far clearer,” he notes.

Managing Risk in Transit and Storage

Developers frequently rely on fragmented coverage placed by several different parties, including manufacturer, transporter, freight forwarded, supplier, and warehouse owner. Seltzer’s solution: a consolidated property program (inland marine policy), ensuring all parties’ interests are covered as the material moves from the first time by the supplier to the last time when delivered to the project site since the developer/owner pays 100% of all costs.

“Fragmented programs lead to finger-pointing, lengthy subrogation, and costly disputes,” he states.

Cyber Risks: The Silent Threat

Additionally, Seltzer flags two cyber threats:

- Social engineering – Fraudulent payment requests and spoofed emails. SOPs requiring verbal confirmation before wiring funds mitigate risk.

- Ransomware – Malicious actors lock systems until ransom is paid, potentially crippling operations.

“Cyber Insurance exists but must be carefully structured, as coverage varies from one carrier to the next, and given the nature of this risk, often the insuring agreement is not keeping up with the times,” explains Seltzer.

Why Professional Liability (aka E&O) is the “Wild West”

Unlike per state statutory workers’ compensation, professional liability is highly customized. “Just because someone buys professional liability doesn’t mean it’s done correctly,” Seltzer warns. Customization requires experienced guidance—otherwise, developers assume risk unknowingly.

Front-End Planning and Contract Structure

Seltzer says that front-end planning is where risk—and opportunity—resides. “Developers who engage deeply in the process can materially reduce ‘Total Cost of Risk’ or TCOR.”

Contracts should hold the party performing work financially responsible, with indemnification for others, and name the developer as an additional insured (excluding workers’ comp and professional liability). But additional insured coverage is nuanced. “Over 100 endorsements exist, and many only cover work during active operations, not during the statute of repose,” Seltzer notes.

Evaluating Modular Suppliers and Closing Coverage Gaps

Developers must examine suppliers’ schedules, financial stability, and backup plans. Seltzer recommends:

- Reviewing proposed Gantt charts or CPM schedules

- Considering performance, supply, or completion bonds

- Negotiating reciprocity agreements for alternate manufacturing

Coverage gaps often appear in transportation, additional insured endorsements, professional liability, and builder’s risk. Choosing the right advisor is critical. Risk is rarely mishandled because developers don’t care, but because they may trust an insurance broker with little to no modular expertise

Surround Yourself with Experts

Finally, Seltzer emphasizes that risk evolves. “Surrounding yourself with really well-intended experts is the best way. And run it as a business. Insurance decisions should be intentional, dynamic, and continuously reassessed. Don’t just buy insurance from the same person you’ve always bought from. Risk is dynamic, and that can create risk. Have an advisor that stays involved and asks good questions.”

If you’re looking for a risk advisor with deep industry insight and a hands-on, analytical approach, connect with Daniel Seltzer at RCM&D at dseltzer@rcmd.com or 800-346-4075.

About the Author: John McMullen, PCM, is the marketing director for the Modular Building Institute. You can reach him directly at mcmullen@modular.org or on LinkedIn.

More from Modular Advantage

AoRa Development Aims for New York’s First Triple Net Zero Building Using Modular Methods

More cities are providing funding for newer infrastructure projects as long as they meet sustainability requirements. This is how modular can fit the bill, thanks to its lower waste production.

Developers and Designers: Lessons Learned with Modular Design

Modular construction is attractive to many developers because sitework and module construction can occur simultaneously, shortening the schedule and reducing additional costs.

UTILE: Putting Modular Building on a Fast Track

In Quebec, UTILE is taking the lead in creating affordable modular buildings to help decrease the student housing shortage. During the process, the company discovered what it takes to make the transition to modular building a success.

Sobha Modular Teaches Developers How to Think Like Manufacturers

With its 2.7 million square foot factory in UAE, Sobha Modular is bringing both its high-end bathroom pods to high-end residences to Dubai while developing modular projects for the U.S. and Australia.

RoadMasters: Why Early Transport Planning is Make-or-Break in Modular Construction

In modular construction, transportation is often called the “missing link.” While it rarely stops a project outright, poor planning can trigger costly delays, rerouting, and budget overruns.

Art²Park – A Creative Application of Modular and Conventional Construction

Art²Park is more than a park building—it’s a demonstration of what modular construction can achieve when thoughtfully integrated with traditional materials. The use of shipping containers provided not only speed and sustainability benefits but also a powerful structural core that simplified and strengthened the rest of the building.

Building Smarter: A New Standard in Modular Construction Efficiency

Rising material prices, labour shortages, expensive financing and tightening environmental rules have made conventional construction slower, costlier, and more unpredictable. To keep projects on schedule and within budget, builders are increasingly turning to smarter industrialized methods.

Resia: Breaking All the Rules

Resia Manufacturing, a division of U.S.-based Resia, is now offering prefabricated bathroom and kitchen components to industry partners. Its hybrid fabrication facility produces more precise bathroom and kitchen components (modules) faster and at lower cost than traditional construction. Here’s how Resia Manufacturing does it.

How LINQ Modular Innovates to Bring Modular To The Market in the UAE and Beyond

LINQ Modular, with an office and three manufacturing facilities in Dubai, is a modular firm based in United Arab Emirates. The company is on a mission: to break open the housing and construction markets in the Gulf Cooperation Council (GCC) area with modular.

ModMax: Redefining Modular Construction with Confidence and Precision

ModMax was born out of frustration—frustration with five persistent pain points in modular construction: Permitting bottlenecks. Production delays. Rigid designs. Disconnect between “the office” and the field. Lack of transparency and communication.