How LINQ Modular Innovates to Bring Modular to the UAE Market and Beyond

LINQ Modular, with an office and three manufacturing facilities in Dubai, is a modular firm based in United Arab Emirates. The company is on a mission: to break open the housing and construction markets in the Gulf Cooperation Council (GCC) area with modular. The factory and firm is part of a host of other companies owned by ALEC Holdings.

Graham Petty, with over 20 years of experience in envelope and facade development, joined the modular firm in 2022. He is part of a dedicated push to usher in modular to the GCC and beyond.

“My last project with ALEC was two high-rise towers with the world’s largest cantilever,” he said. “It was a project called One Za’abeel and I delivered the Facade package for them, which was around $150 million.”

After working in envelope performance, he decided to make a career pivot to focus on modular, joining LINQ Modular as their Operations Manager.

“When I joined LINQ, we [saw] upcoming demand in the GCC for modules, primarily in Saudi Arabia,” he said. “They were doing a lot of remote developments in areas where it’s difficult to get manpower and materials out there, such as Neom and the Red Sea.”

LINQ Modular focuses on producing modules for remote locations, as the supply chain and labor is readily available in Dubai.

Due to the prevalence of desert lands and heat, the UAE and the GCC region are increasingly reliant on structures that provide shelter from high temperatures without leaks.

“It’s super hot here, so U-value and envelope performance is key,” said Graham.

With LINQ, Graham worked on the first modular project for the company, a resort project for Sindalah Island, off the Red Sea coast of Saudi Arabia in 2022. The firm delivered 510 modules which served as service apartments for Marriott. The volumetric steel frame modules were fitted out with traditional drywall and were delivered throughout 2023.

While hotel and multi-use buildings were in need of modules, LINQ Modular found that the market gap for modular housing was growing, said Graham. However, the firm faces some challenges in introducing modular to the GCC region.

The Cultural Challenges Facing Modular in the UAE

“There is quite a negative perception about modular construction in this region and that’s primarily because of all the building codes in the UAE,” said Graham.

As Dubai expanded due a construction boom in the 90s, most structures were built primarily with block work and concrete, he said. These run opposite to the drywall construction offerings found in most modules.

Modular was first introduced to the Arabian peninsula around 2015, with people taking a closer look at how the construction method could help address structural and housing design.

“A lot of the modular suppliers tend to focus on temporary builds such as offsite offices and ADU cabins,” noted Graham. “You do get modular manufacturers here that focus on permanent builds but they use drywall.”

Since then, concrete block work has been the preferred method for building structures in the UAE. Because drywall was typically associated with temporary structures, and concrete with more permanence—the stigma of cheap or low value remains attached to drywall.

There is also the issue of cost with regards to material and labor. Concrete block work and associated construction labor costs remain low in the UAE, in comparison to other places like in Europe and the rest of the world. As a result, developers and construction companies are less inclined to shift to modular, which relies heavily on the lightness offered by drywall and other materials to enable quick delivery and installation.

Graham says that Saudi Arabia has shown more of an appetite for modular, as big modular developers are now targeting remote developments with their prefabricated solutions to save money on energy and maintenance costs.

For example, the first project LINQ Modular worked on in Saudi Arabia received a LEED Gold certification thanks to its energy efficiency performance. The firm also has three ISO certificates for quality management, environmental management, and occupational health and safety management systems.

However, even with these certificates and pushes toward sustainability, the housing market in the UAE has been slower than other countries to adopt modular despite the potential benefits.

“It is very cost prohibitive and the market is more cost-driven rather than quality-driven, which is a bit of an issue,” he said.

Using Lightweight Foam Concrete

In 2024, LINQ Modular discovered a different solution to help address their barriers to market entry.

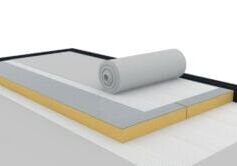

“We’ve had a look at different technologies to make walling and envelope technology feel a lot more solid while still maintaining a superior performance in terms of acoustics and thermal,” said Graham.

In using a conventional drywalling system filled with lightweight foam concrete instead of glasswool or rockwool, LINQ Modular could mimic the feel of a concrete wall without sacrificing time or quality.

Modular faces stiff opposition in the GCC region, as the methodology currently accounts for “barely 1 percent of builds,” said Graham. “It is quite a niche, so we’re trying to break down those barriers.”

In doing so, LINQ Modular is entering a promising new partnership that enables them to use that new tech to provide “modular housing for people who wouldn’t have considered it previously.”

Retaining Modular Business and Sustainability Goals

As a result, LINQ Modular is embarking on new ventures to educate developers and customers on the benefits of modular. The 24-hour factory in Dubai has six modular production lines, with modules moving up and down as needed, so workers can remain stationary and perfect their craft.

The second facility focuses on light gauge steel (LGS) forming and wall panels, while the third facility provides board processing such as socket cutouts using CNC machines in addition to forming bulkheads.

LINQ Modular also prides itself on minimizing waste especially with pollutants like gypsum boards, on top of providing precise measurements for their LGS walling systems to avoid excessive drilling and cutting.

“We have very minimal waste on gypsum boards. Our LGS system is pulled directly from the BIM model,” said Graham. “We run a software called Vertex that feeds directly into the light gauge steel machines. All of the light gauge steel machines have inbuilt punches as well. Everything is fully automated in that sense. It’s treated as a real assembly line, so there’s no fabrication that happens within our main facility. And we have key partnerships established with our joinery supply. So everything comes as a kit.”

These facilities are providing the new prototypes for the upcoming partnership. The prototypes feature five bedroom structures that include a majlis, a large room where end users can invite guests over for dinner or use as a space to sit and chat, said Graham.

“These five bedroom villas with a built-in majlis, living spaces, and bathrooms are quite a big deal,” he said. “They’ve opened doors for us to approach mainstream developers that can sell to the general public and expatriates.”

Creating a Standardized Townhouse Modular Product

The firm is also creating a townhouse modular product, a first for the primarily project-led company. Spanning over two floors and three bedrooms, the four-module structure is about 2,000 square feet overall and is made of steel and lightweight foam concrete. Each module measures about 3.8 meters wide by 11 meters long.

“We do see a lot of mileage in the product here in the GCC,” said Graham. “There is a critical shortage in town housing and villas here in the region. Rental and property prices for those kinds of schemes are going through the roof, and that’s because there is not enough supply coming into the market.”

The gap in quality is increasing slowly but surely, which also offers another opportunity for LINQ Modular.

“Because the market for producing townhouses is so cost-driven, developers are forced to appoint tier three contractors to maintain their margins, sometimes tier four contractors, and they’re not capable of producing quality housing,” said Graham. “And that is becoming more and more prevalent, especially on the newer developments. So we do see that the market is going to shift, but it is taking time.”

On top of their housing products and burgeoning projects, LINQ Modular continues to break ground by winning contracts in both Saudi Arabia and beyond. They have most recently won a resort project for a beach resort in Abu Dhabi.

“The main driver for those guys going modular is obviously quality,” he said. “As the resort is about a three-hour drive outside of town, they can see the benefit in producing offsite somewhere local.”

Expanding Past the GCC to the U.S.

The Dubai-based firm is also working on their first U.S.-bound product. One such project involves the development of 270 modules for 32 homes in California in addition to creating their first ever ADU for the state as well.

“It’s just going through certification at the moment,” said Graham. “Obviously we want to make sure the design is fully compliant before we progress with manufacturing and selling, but we’ve got a couple of distributors lined up for that as well.”

The company is aiming to start producing the modules for California in April of 2026.

About the Author: Karen P. Rivera is a freelance writer and editor with a passion for storytelling. She is a former United Nations-based reporter, with experience covering international breaking news, venture capital, emerging healthcare tech, and the video game industry.

More from Modular Advantage

Resia: Breaking All the Rules

Resia Manufacturing, a division of U.S.-based Resia, is now offering prefabricated bathroom and kitchen components to industry partners. Its hybrid fabrication facility produces more precise bathroom and kitchen components (modules) faster and at lower cost than traditional construction. Here’s how Resia Manufacturing does it.

ModMax: Redefining Modular Construction with Confidence and Precision

ModMax was born out of frustration—frustration with five persistent pain points in modular construction: Permitting bottlenecks. Production delays. Rigid designs. Disconnect between “the office” and the field. Lack of transparency and communication.

LifeArk: Disaster-Resilient Housing from Recycled Plastic and 100-year-old Technology

Wee compares LifeArk’s housing units to Yeti coolers, as they are built similarly. Each component takes 15 to 20 minutes to manufacture, has an R-value of 40, and includes molded slots and chases for wiring, plumbing, fire sprinklers, and other utilities.

Building the Future of Modular Edge Infrastructure

The edge data center market is expanding rapidly, driven by the surge in AI workloads, IoT adoption, and the need for localized compute power. In these environments, sustainability, scalability, and reliability are non-negotiable. Cooling is among the most complex challenges for operators—and one of the most decisive factors in long-term success.

Accelerating Light-Gauge Steel Construction: A Semi-Automated Digital Workflow for Off-Site Projects

For construction professionals, the message is clear. By adopting semi-automation and digitalization, companies can deliver projects faster, more accurately, and more profitably, while also building stronger collaboration across teams. The approach is not about replacing people with machines, but about empowering people with better tools and processes.

Why Modular Data Centers Are Gaining Momentum

Artificial intelligence, high-performance computing, and edge applications push the limits of traditional “stick-built” data centers. They take years build, often struggle with high density workloads, and aren’t optimized for deployments near end users. Modular data center platforms are purpose-built to address these challenges, offering flexibility and scalability to adapt to evolving technologies, while opening new opportunities for the modular construction industry.

Supply Chain Innovation in Action: 5 Habits Every Modular Leader Should Practice

By applying these principles to supply chain practices — collaborative planning, strategic procurement, scenario modeling, digital tools, and transparent forecasting — construction leaders can build value chains that are not just efficient and agile, but truly innovative.

Exploring the Role of Modular Integrated Construction (MiC) in Advancing Circular City Principles – A Survey of Stakeholder Perspectives

The survey findings highlight the significant potential of Modular integrated Construction (MiC) in advancing the development of circular cities. By reducing costs, accelerating construction timelines, and minimizing waste generation, MiC offers a promising approach to sustainable urban development.

The Use of MS POLYMER™-Based Sealants and Adhesives in Modular Building

These products combine flexibility and elastic recovery with excellent adhesion to different substrates and have already shown their usefulness in traditional construction. Now it’s time for them to be put to use in the modular construction industry.

From BIM to Execution: Turning a “Pretty Picture” into a Single Source of Truth for Off-Site Construction

When implemented properly, BIM becomes the company’s digital backbone: connecting teams, standardizing information and transforming data into actionable insights. It is the key to achieving lean, predictable operations where all phases – design, planning, procurement and project execution are empowered by a single source of truth.