Unlocking NYC’s Housing Potential: Scaling Modular Construction for Affordable Living

Simon Sai Man Li, LEED AP BD+C, is a MS Construction Administration at Columbia University

New York City stands at a pivotal moment in its housing history. With over 60,000 individuals in city-funded shelters and soaring construction costs, the city faces a housing shortfall that threatens both its economic competitiveness and social equity. Traditional building methods are proving too slow and expensive to meet demand, but a viable alternative already exists.

Modular construction, which involves the off-site fabrication of volumetric units that are rapidly assembled on-site, presents a compelling path forward. Research conducted through my graduate thesis at Columbia University, supported by over a dozen expert interviews and comparative case studies, reveals that modular construction is not only feasible in NYC but also essential for delivering the scale and speed needed to address the city’s affordable housing crisis.

Current projections indicate that the New York City region will require 1.2 million new housing units by 2040. However, under existing zoning rules, only about 580,000 units can feasibly be built. This imbalance between supply and demand is driving up rents, accelerating displacement, and deepening inequality. Meanwhile, traditional construction methods are constrained by labor shortages, logistical complexity, and regulatory barriers.

Within the first quarter of 2025, house prices in the EU increased by 5.7%, and rents increased by 3.2% compared with the same quarter the previous year. Overall, house prices across the EU have risen on average by nearly 50% in the last 8-year period. The continued increase in demand and lack of supply is only going to compound the situation.

According to EUROSTAT, the EU averages for housing types in cities is around 70% of people live in apartments and 30% live in houses. The suburbs and towns have around 40% living in apartments and 60% living in houses. Without exception, the modular building industry can provide new build solutions for all of these requirements.

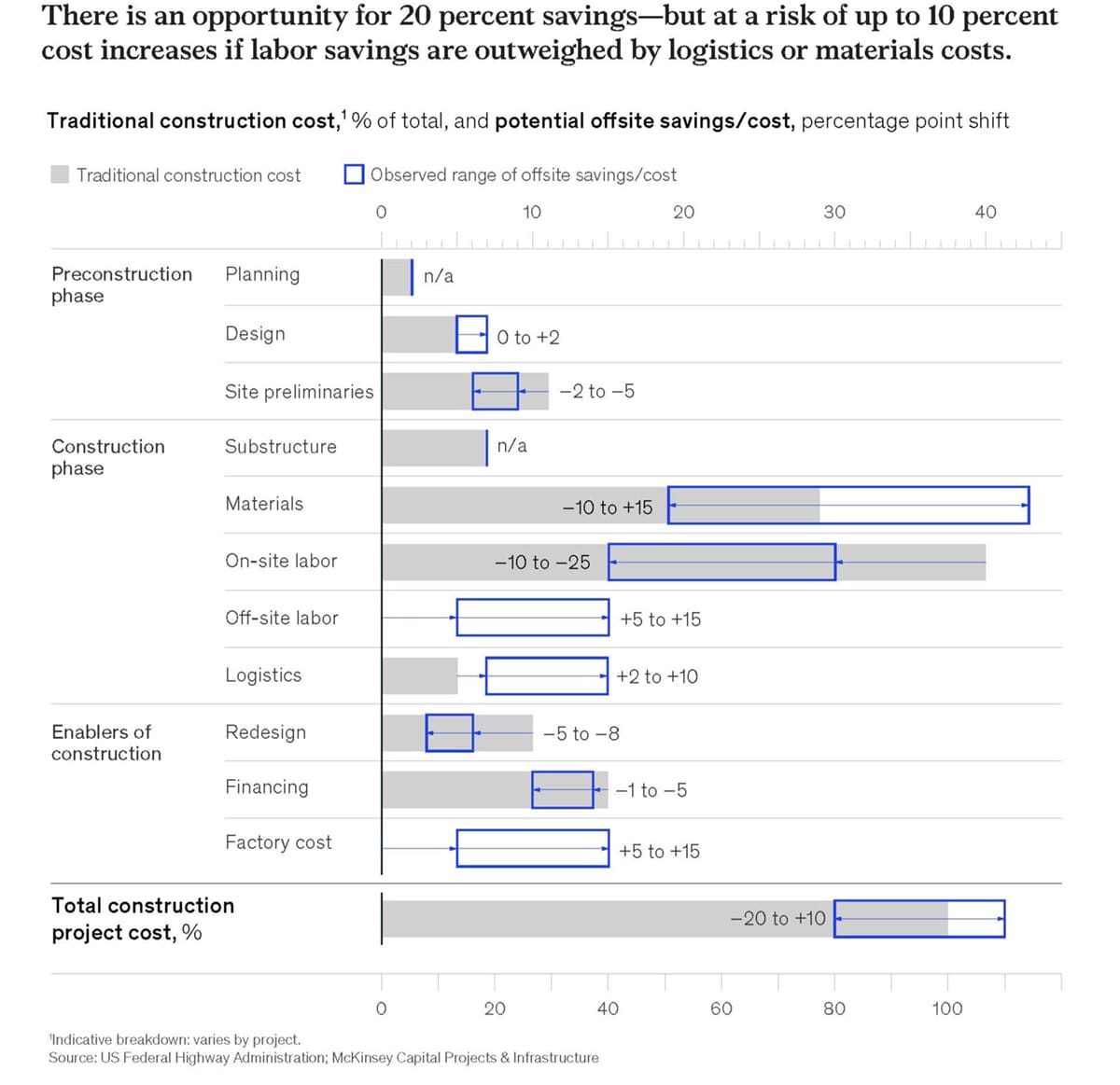

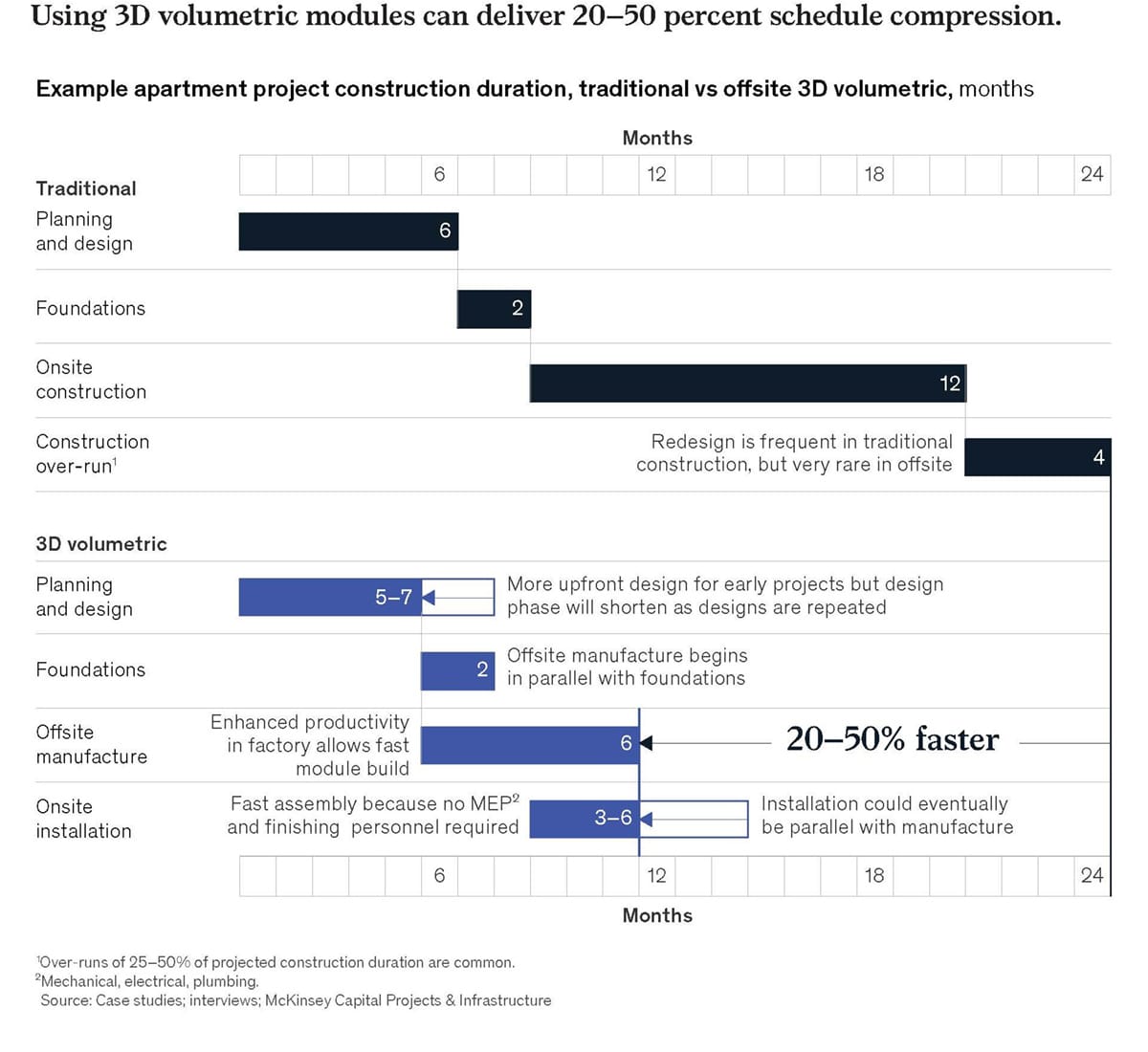

Modular construction has the potential to address these constraints. According to McKinsey & Company, modular construction can reduce project timelines by up to 50 percent and lower costs by as much as 20 percent. For affordable housing, where margins are tight and speed is critical, these advantages can be transformative. Factory-controlled environments also enhance quality and safety by reducing rework and minimizing weather-related delays.

Despite these benefits, modular construction remains underutilized in New York City. Understanding why this is the case is key to unlocking its potential.

Potential Modular Construction Time Savings. Source: McKinsey Company

Although modular construction offers clear benefits, its wider adoption in NYC is hindered by four primary challenges:

1. Outdated Building Codes

The city’s current codes prohibit wood-framed modular systems in multifamily buildings and instead mandate steel construction for nearly all residential structures. This is in stark contrast to cities like Boston and Philadelphia, which allow fire-treated wood framing in buildings up to 85 feet tall.

2. Fragmented Oversight

Factory-built modules must often pass duplicative inspections from both local and out-of-state authorities. The lack of clarity over jurisdictional responsibilities combined with the absence of formal agreements recognizing prior inspections results in fragmented oversight. Without a framework for mutual recognition or streamlined local verification, these redundancies introduce delays and undermine the core time-saving potential of modular construction.

3. Incompatible Financing Models

Conventional lending practices disburse funds in stages as onsite work progresses. Modular projects, however, require substantial upfront capital to fund off-site fabrication, creating cashflow gaps that many developers struggle to manage.

4. Workforce and Supply Chain Gaps

There is currently insufficient modular manufacturing capacity within or near the city. Most regional factories are located out of state and specialize in wood-frame modules, which are not allowed under NYC’s existing building code.

Several NYC pilot projects have demonstrated modular construction’s potential while also revealing key implementation challenges:

Carmel Place (Manhattan)

This micro-unit modular development was completed swiftly and efficiently using just 55 modules assembled in under a month. However, it required mayoral zoning overrides and offered only limited affordable housing.

461 Dean Street (Brooklyn)

This 32-story project, once the tallest modular tower in the world, revealed the risks of high-rise modular development. Issues such as module misalignment and water infiltration caused major delays and cost overruns.

Linden Grove (Brooklyn)

This senior housing development highlights persistent logistical issues. Challenges such as restrictions limiting deliveries to a single designated weekday and inconsistent coordination have slowed progress despite careful planning.

Each case reinforces the value of modular construction but also underscores the need for modular-specific code reform, streamlined interagency oversight, and better-integrated project delivery structures tailored to modular workflows.

To move modular construction into the mainstream, New York City must implement targeted reforms across five key areas:

1. Modernize Building Codes

NYC must revise its building codes to permit fire-retardant-treated (FRT) wood-frame modular systems in mid-rise multifamily developments, up to 85 feet, mirroring cities like Boston and Philadelphia that already allow this under the IBC. Current restrictions under §602.3 and NYC’s Fire District provisions effectively ban combustible materials in exterior walls, even when fully sprinklered, forcing reliance on expensive steel-framed modules. Targeted amendments allowing UL-listed, 2-hour fire-rated FRT wood assemblies with NFPA 13 sprinklers would expand access to regional wood-based manufacturers currently excluded. In tandem, establishing a modular-specific code section and a standardized modular design reference framework would reduce compliance ambiguity, streamline plan reviews, and accelerate approvals. Together, these reforms would lower costs, increase supply capacity, and create a regulatory environment that encourages broader adoption of modular construction for affordable housing.

Potential Modular Construction: Time Savings. Source: McKinsey Company

2. Streamline Permitting and Inspections

A fast-track permitting pathway should be established specifically for modular affordable housing. A cross-agency review team including DOB, FDNY, DEP, DOT, DDC and HPD would help synchronize review cycles and eliminate sequential approval bottlenecks. Adopting mutual recognition of third-party factory certifications from out-of-state agencies could also eliminate redundant inspections, further reducing delays.

3. Realign Financial Tools

New financial instruments must accommodate modular construction’s upfront-heavy cost structure. Tax credits, grants, and low-interest loans tailored to modular projects would ease capital constraints. HPD is currently developing modular-specific term sheets to help developers align financing with production timelines; once formalized, these should be expanded in scope. A dedicated NYC modular housing fund could further attract investors and enable larger-scale developments.

4. Foster Public-Private Partnerships

City-owned land should be used strategically to continue piloting modular developments, with ground leases or reduced land costs enabling affordability. A “Modular Housing Accelerator” task force composed of public agencies and industry representatives could support these pilots from design through completion, ensuring aligned expectations and streamlined delivery. Knowledge-sharing forums should also be established to spread lessons learned across the sector.

5. Invest in Workforce and Local Manufacturing

Educational institutions, modular firms, and trade associations must collaborate to create modular-specific training and certification programs in areas such as DfMA workflows, fabrication-level 3D modelling, on-site module installation, and off-site module fabrication. At the same time, city incentives can encourage the establishment of local modular factories, enhance logistical infrastructure while anchoring job creation in local communities.

Scaling modular construction is not just about changing how we build. It requires a systemic shift in policy, financing, procurement, and workforce development. None of these reforms will succeed in isolation, but together they can transform modular housing from a niche solution into a core component of NYC’s affordable housing strategy.

When these changes are implemented in tandem, they have the potential to:

- Shorten development timelines and improve cost predictability

- Expand access to high-quality, affordable homes across all boroughs

- Stretch public funding further and deliver more units for each tax dollar

- Strengthen local economies by generating new jobs in construction and manufacturing

- Establish NYC as a national leader in modular innovation and housing policy

By removing the policy and market barriers currently impeding modular growth, New York can enable developers, manufacturers, and city agencies to collaborate in new and improved ways. The result will be a faster, more predictable, and more affordable pathway to meeting the city’s housing needs.

More from Modular Advantage

AoRa Development Aims for New York’s First Triple Net Zero Building Using Modular Methods

More cities are providing funding for newer infrastructure projects as long as they meet sustainability requirements. This is how modular can fit the bill, thanks to its lower waste production.

Developers and Designers: Lessons Learned with Modular Design

Modular construction is attractive to many developers because sitework and module construction can occur simultaneously, shortening the schedule and reducing additional costs.

UTILE: Putting Modular Building on a Fast Track

In Quebec, UTILE is taking the lead in creating affordable modular buildings to help decrease the student housing shortage. During the process, the company discovered what it takes to make the transition to modular building a success.

Sobha Modular Teaches Developers How to Think Like Manufacturers

With its 2.7 million square foot factory in UAE, Sobha Modular is bringing both its high-end bathroom pods to high-end residences to Dubai while developing modular projects for the U.S. and Australia.

RoadMasters: Why Early Transport Planning is Make-or-Break in Modular Construction

In modular construction, transportation is often called the “missing link.” While it rarely stops a project outright, poor planning can trigger costly delays, rerouting, and budget overruns.

Navigating Risk in Commercial Real Estate and Modular Construction: Insights from a 44-Year Industry Veteran

Modular projects involve manufacturing, transportation, and on-site assembly. Developers must understand exactly what they are responsible for versus what they subcontract. Risk advisors should research the developer’s contractors, subcontractors, and design-build consultants—especially the modular manufacturer.

Art²Park – A Creative Application of Modular and Conventional Construction

Art²Park is more than a park building—it’s a demonstration of what modular construction can achieve when thoughtfully integrated with traditional materials. The use of shipping containers provided not only speed and sustainability benefits but also a powerful structural core that simplified and strengthened the rest of the building.

Building Smarter: A New Standard in Modular Construction Efficiency

Rising material prices, labour shortages, expensive financing and tightening environmental rules have made conventional construction slower, costlier, and more unpredictable. To keep projects on schedule and within budget, builders are increasingly turning to smarter industrialized methods.

Resia: Breaking All the Rules

Resia Manufacturing, a division of U.S.-based Resia, is now offering prefabricated bathroom and kitchen components to industry partners. Its hybrid fabrication facility produces more precise bathroom and kitchen components (modules) faster and at lower cost than traditional construction. Here’s how Resia Manufacturing does it.

How LINQ Modular Innovates to Bring Modular To The Market in the UAE and Beyond

LINQ Modular, with an office and three manufacturing facilities in Dubai, is a modular firm based in United Arab Emirates. The company is on a mission: to break open the housing and construction markets in the Gulf Cooperation Council (GCC) area with modular.