Modular and Off-Site Construction: Risk Questions, Scenarios, and Suggestions

B. Daniel Seltzer, CPCU, is a principal of Seubert & Associates, Inc.

Thanks to our friends at MODLOGIQ, we are proud to announce ourselves as a new member of the Modular Building Institute. Thank you for the warm welcome at World of Modular in Las Vegas last April. We hope to establish long-term, trusting relationships with MBI members, and we look forward to participating in the upcoming expos and the World of Modular in 2024.

We offer the following thoughts as an introduction to Seubert & Associates, Inc.

Question #1: Is your insurance company an adversary or a partner?

My 42 years in the business indicates neither is the correct answer! Carriers are experts at assuming specified, fortuitous, quantifiable risk with conditional promises to pay IF various distinct facts occur, all in exchange for your premium dollars. Who has the advantage on this playing field?

Question #2: Who composes the fine print of the insurance contract, and for the benefit of whom?

The multi-billion-dollar carrier and reinsurers standing behind the contract, or the MBI member reading this article? Who would you bet on, and what tools are at your disposal to improve the rules of the game? Who to turn to, and when?

Question #3: Are you prepared?

When considering risk exposure in your industry, many traditional construction risks are mitigated. A few examples of reduced risk include theft of materials, bodily injury, and enhanced quality. Any new risks? Can you identify exposures created by modular construction? There are a handful. Have you prepared?

Building upon these questions, I invite you to consider the following scenarios.

Scenario #1

To level the playing field, is the best choice of insurance agent one who first obtains copies of your policies, then floods the market with e-mails to hopefully find the lowest rate from the hot underwriter on that given day? Or are chances enhanced by working with a trained risk management professional serving as your broker, who is fiercely independent and understands your exposures to loss at least as well as yourself?

Scenario #2

We are currently experiencing the “hardest market” in over 350 years; insurance rates have increased 19 quarters in a row. This has never happened before, ever! Do you understand why? If you know the dynamics, including your risk profile, you can reduce your Total Cost of Risk.

With the preceding insights in mind, let’s explore suggestions to effectively navigate the complexities of the insurance and risk transfer landscape.

Suggestion #1

Although the “modular” and “off-site” construction business is not new, it is a relative newcomer, and not as mature as the insurance industry. Insurers are conservative by nature and utilize historical data to promulgate rates. When actuaries determine data is not statistically credible, what do you believe is the result? Exactly, lack of competition and unattractive pricing! I believe MBI and its members can do something about this phenomenon.

Shall we discuss?

Suggestion #2

Businesses are glued together by contracts. Try improving your risk profile and how you present yourself to underwriters. This will yield impressive results compared to obtaining bids from hungry insurance salespeople. Arrange for new eyes to review your important contracts and implement best practice processes.

Suggestion #3

Encourage your insurance agent/broker to include you in the negotiating process with underwriters, and I mean directly. Sure, the best risk management professionals can “pitch” your account from an exposure, coverage, and strategic perspective, but no one will have more interest and knowledge of your business operations than yourself. If “prepped” correctly by your broker, you would bring the “special sauce,” which is missing in 95% of insurance submissions in the marketplace. Do not wait for insurers to lower rates. It will not happen until market forces create competition. Currently, reinsurance capacity has been seriously depleted, which restricts competition. Take control!

Real Life Example

Why the insurance advocate you entrust with protecting your assets and shielding your organization from liability is essential to your survival as an entrepreneur.

Most insurance brokers focus on where the commission dollars come from, and how to earn more. The best brokers take their work seriously and are fulfilled when they know their client is correctly insured.

Greater than 65% of the commission dollars for MBI manufacturers and contractors are within General Liability, Workers’ Compensation, and Excess Liability insurance policies – this is important coverage for sure.

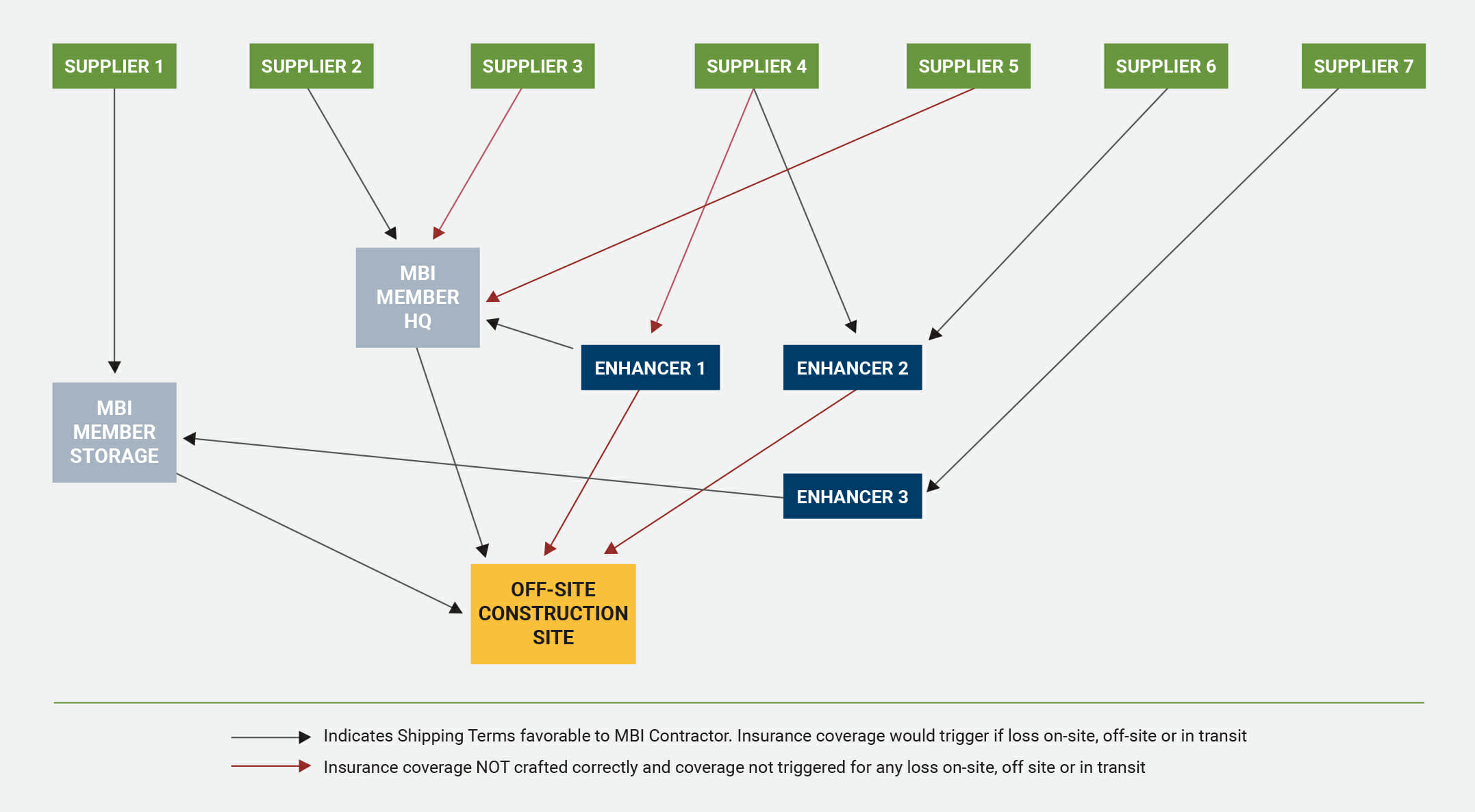

May we talk about Property and Inland Marine coverage for a moment? It is rare to meet an insurance professional who, WITH REAL PURPOSE, asks the correct questions to assure their client is situated properly. I am happy to discuss why if you wish. For now, ask yourself two simple questions. First, does your insurance “person” truly understand when, why, how, and to what extent your insurable interest in property is created and when it ceases? See the graphic below which supported a new MBI client’s suspicion of their prior insurance agent not paying attention.

Second, once these questions are answered, does your broker understand and then suggest cost-effective solutions?

Considering the unique nature of modular projects, MBI members need to carefully address surety considerations to ensure successful outcomes.

1. Surety Selection

Selecting a quality surety professional is of utmost importance. When researching a firm, consider their years of experience and amount of bonds written, current

relationships with underwriters, and the memberships they hold to various professional associations, as well as their overall knowledge of your unique industry. By partnering with a reputable consultant, you can ensure reliable performance that maximizes your bonding capacity.

2. Design Elements

Failures during the design stage will trigger delays and increase costs. If the contractor is responsible for designing the project, delays will cause margins to shrink, eat into working capital, and impact the balance sheet, which is integral to surety underwriting decisions.

3. Supplier Risk

Contractor must know:

- Can the manufacturer meet the timeline?

- What happens if the manufacturer cannot meet the schedule or ceases business operations?

- Can the contractor replace the manufacturer, or will the contractor need to return to the design/engineering stage with a new manufacturer?

4. Transportation

Increased costs result from shipping delays and damages, which can trigger liquidated damages or actual damages clauses. Related to damage delay clauses, contract language must be reviewed. Surety underwriters want to make sure the contractor can meet the timelines.

5. Construction Defects

Modular build quality can suffer with the wrong employees or misused automation equipment. Contractors should ensure the right labor is in place, understand local legislation, and always keep quality at the forefront. To help with the underwriting process, modular contractors should be able to answer questions regarding their experience with the modular building supplier and the process to prequalify the supplier.

6. State and Local Building Codes

Modular contractors should be aware of varying state and local building codes. Surety underwriters ensure contractors are knowledgeable about these codes. If a contractor is moving into a new territory, surety underwriters will remind contractors that building code knowledge is key.

7. Prevailing Wage Issues

In some states, contractors are responsible for unpaid prevailing wages and unpaid penalties, even if a subcontractor or supplier completed the work. The contractor must assess its contractual obligation to determine if a modular builder will fall under a subcontractor, manufacturer, or supplier classification.

8. Labor

The difference in complexity between a single-story modular building and a high-rise or mixed-use development modular building can be exponential. Construction labor availability continues to be a major challenge, and the lack of experience assembling these buildings can make it more difficult for contractors looking to enter the modular building market. Surety underwriters will ensure the right labor is in place to complete the project within its parameters.

More from Modular Advantage

Samantha Taylor: Leading the (Modular) Design of Tomorrow

“With modern technology and the way we’ve all embraced things like BIM, file sharing, and video conferencing since COVID, it’s easy to collaborate with companies in Austria, or Singapore, or anywhere else in the world.”

Greg DeLeon: Military Engineering to Modular Design

Greg DeLeon, a structural engineer at ISE Structural Engineers in Temecula, California, can tell you not only how large a beam needs to be to support a house, but also how much explosives you’ll need to take it down, thanks to his unique combination of professional and military experience.

To Remake North Minneapolis, Devean George Swaps Basketball for Buildings

He’s lived in Los Angeles, Dallas, and San Francisco (to name a few). He’s delivered championships with the Los Angeles Lakers and made career-defining moves with the Dallas Mavericks and the Golden State Warriors. No matter the wins, the championships, or even the seemingly impossible 3-pointers, Devean George has always returned to where it all started for him: Minneapolis.

Chelsi Tryon: Making the World a Better Place

For Chelsi Tryon, Director of Environmental, Social, and Governance (ESG) for WillScot Mobile Mini, nothing is more enjoyable than increasing the

company’s sustainability efforts while simultaneously doing her bit to save the environment.

Joshua Hart: Pushing Boundaries

Joshua Hart, P.E., vice president at Modular

Solutions, can sum up his job responsibilities in one sentence: “I do whatever needs to be done.” Hart thrives on the variety and the opportunity to be involved in every aspect of the company. And it shows! You might say Hart has come full circle.

Jamie Metzger: From Construction to Apparel and Back Again

Growing up in a blue-collar city like Edmonton, Alberta, Canada, it’s no surprise that Jamie Metzger spent some time working labor jobs on construction sites. It’s one of the most common summer jobs in the city. But that’s probably the last predictable thing about this particular story.

Victor Masso: Expanding Modular in Puerto Rico

Victor Masso joined 2 Go Storage, a company started by his grandfather and father, in 2018 to develop a modular building division in the wake of the devastation caused by Hurricane Maria in 2017. Prior to joining the company, he had worked in the industry for about four years focusing on pharmaceutical, commercial, and government projects.

Eliyah Ryals: Finding the Perfect Fit

It’s not common for people to find their perfect career fit straight out of college. It’s even less common to find it in the town you grew up in. But that’s exactly what happened when Eliyah Ryals was told about vacancies at Panel Built and made the decision to apply.

Through It All, It’s Still About the Workers

By February 2024, the number of available, unfilled construction job openings had reached an all-time high. At some point, interest rates will fall, creating another surge in demand for such workers. In short, solving the nation’s skilled worker shortage issue has never been more important.

Navigating Insurance Challenges in the Modular Construction Industry

Utilizing practical written minimum insurance and indemnity requirements, along with monitoring certificates of insurance by someone who has COI training will not yield a perfect risk transfer strategy, but the exposure will be managed much better than it likely is currently.