Plug-and-Play: The Emergence of Modular Data Centers

Kent Anderson is the Senior Business Development Manager at Wesco Distribution.

As organizations across industries rapidly push to digitize and modernize their operations, buildings and factories — embracing IoT and AI along the way — they need to ensure their data center capacity can keep pace and do so quickly. After all, these innovative applications require a certain level of computing power to run. That demand is fueling the rapid rise of data center construction projects. According to research from McKinsey, U.S. data center growth is expected to increase 10 percent per year through 2030.

However, simply adding more computing power is not as straightforward as it seems. Traditional data centers can take anywhere from 12 months to two years or more to design, build and begin operating. Plus, organizational complexities and ongoing supply chain challenges can hinder a rollout, especially in more remote areas where logistics and labor availability are especially challenging. As a result, modular data centers have emerged as a workaround for a variety of applications.

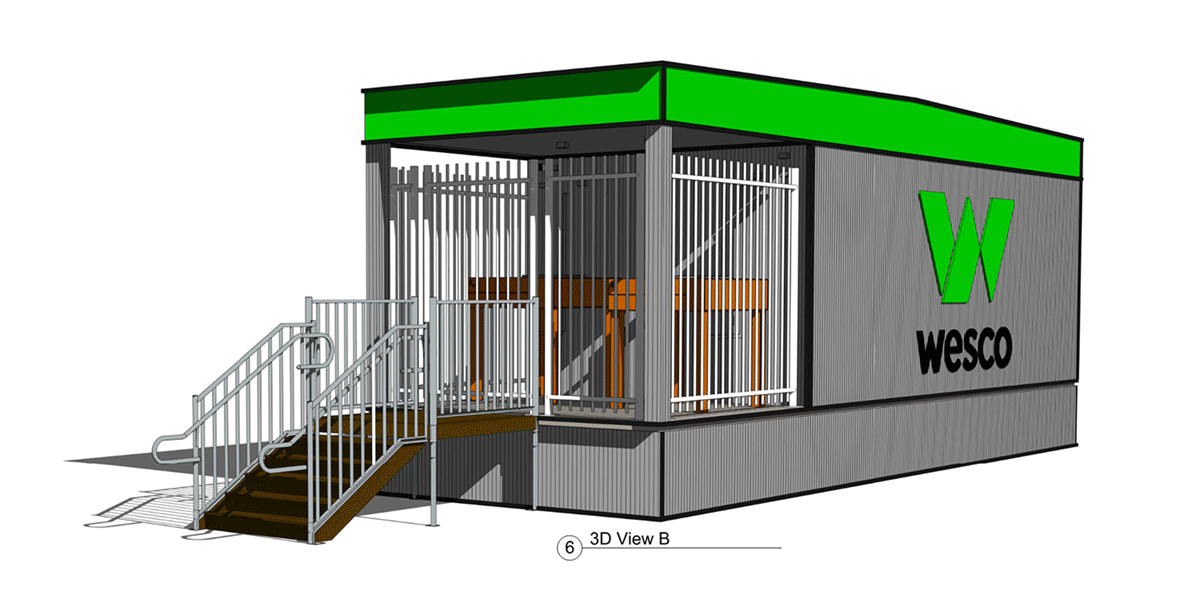

These structures are built offsite and fully assembled, complete with HVAC and electrical. Once completed and inspected, modular data centers can be delivered to the jobsite ready to support the speed, volume and data capacity requirements that organizations so desperately need. All that’s left to do is simply drop in the hardware.

Let’s take a closer look at why the “plug and play” capabilities of a modular data centers matter right now.

Renderings of a modular data center from Wesco Distribution.

1. Daunting Data Demands

If an organization identifies the need for more computing power, they also probably recognize they need it immediately. However, customized data centers have lengthy lead times and speed of deployment matters if organizations are to truly embrace the efficiency and competitive advantages that come with digitization and AI innovation. Waiting two years to build a data center with the necessary processing power isn’t a viable option.

Modular data centers can alleviate that burden two to three times faster and help companies prepare for future data demands as well. Customizable and built with flexibility in mind, these structures can be relocated to another location to meet evolving data needs or (given their inherent ease and speed of deployment) simply re-ordered to grow the system and enhance processing power as required.

This is especially valuable in locations where space is at a premium such as major metropolitan areas, healthcare and higher-education campuses, or office spaces. Modular data centers can be leveraged as expansion is occurring, and relocated as it completes, seamlessly addressing evolving data demands.

2. Supply Chain Constraints Remain a Constant

The pandemic may be over, but the effect on the supply chain is long-lasting. Sourcing materials is more complicated, more unpredictable, and more expensive than in years past. For data centers, this is especially true as certain equipment or materials —

specifically electrical gear — currently have long lead times. Any delays tied to material availability (or lack thereof) will obviously hinder construction. The longer a project takes, the more capital investment is required to see it through to completion — and all the while data demands are still not being met.

Modular data centers can bypass many of those concerns. Since they’re produced offsite, they arrive almost fully assembled, making them essentially plug and play. This virtually eliminates the potential scenario of waiting onsite for critical or scarce components to arrive.

However, this underscores the need to bring partners in early when considering modular data centers. Whether the equipment is produced offsite or onsite, there is still the potential to run into supply chain challenges for important parts or materials. Bringing in partners early on can help avoid these challenges by ensuring you have the equipment and materials you need, when you need it.

3. Labor Concerns

Skilled labor continues to be a challenge across the construction industry. Employing the right set of people to ensure the data center deployment process is done as quickly as possible is essential. In remote areas, sourcing labor is especially difficult. Crews must be meticulously scheduled and provided with the correct tools and resources to be successful.

Modular construction can help avoid these issues. Skilled workers are already on staff at the production facility, so there’s no need to source additional labor, or compete with other companies for skilled workers who are in high demand. Also, having those skilled workers on staff helps ensure consistency and familiarity with the overall product assembly.

These factors and others are driving organizations to circumvent the traditional approach to data center construction projects and evaluate a new product -- modular structures. Built with speed, flexibility, and redundancy in mind, modular data centers provide the plug-and-play computing power organizations need amidst innovation, uncertainty and more.

More from Modular Advantage

How Stack Modular Is Using AI to De-Risk Mid- to High-Rise Modular Construction

Artificial intelligence is no longer a future concept in modular construction—it is already reshaping how complex buildings are evaluated, designed, and delivered.

Gearing Up for the 2026 World of Modular

The Modular Building Institute (MBI) is bringing its global World of Modular (WOM) conference and tradeshow back to Las Vegas in April, and with it comes some of the industry’s best opportunities for networking, business development, and education.

New High-Rise Modular Apartment in Abu Dhabi Points Toward the Future of Multifamily Construction

Eagle Hills International Properties chose the BROAD Holon Building for a 16-story market rate apartment building in Zayed City, a central business district of Abu Dhabi. The project highlights the potential of the Holon system of volumetric modular construction to accelerate housing delivery.

MBI Announces First Ever Industry Apprenticeship Program in Collaboration with Marshall Advanced Manufacturing Center

MBI recently agreed to partner with Marshall Advanced Manufacturing Center (MAMC) to provide bona fide USDOL-approved apprenticeship programs for the industry.

AoRa Development Aims for New York’s First Triple Net Zero Building Using Modular Methods

More cities are providing funding for newer infrastructure projects as long as they meet sustainability requirements. This is how modular can fit the bill, thanks to its lower waste production.

Developers and Designers: Lessons Learned with Modular Design

Modular construction is attractive to many developers because sitework and module construction can occur simultaneously, shortening the schedule and reducing additional costs.

UTILE: Putting Modular Building on a Fast Track

In Quebec, UTILE is taking the lead in creating affordable modular buildings to help decrease the student housing shortage. During the process, the company discovered what it takes to make the transition to modular building a success.

Sobha Modular Teaches Developers How to Think Like Manufacturers

With its 2.7 million square foot factory in UAE, Sobha Modular is bringing both its high-end bathroom pods to high-end residences to Dubai while developing modular projects for the U.S. and Australia.

RoadMasters: Why Early Transport Planning is Make-or-Break in Modular Construction

In modular construction, transportation is often called the “missing link.” While it rarely stops a project outright, poor planning can trigger costly delays, rerouting, and budget overruns.

Navigating Risk in Commercial Real Estate and Modular Construction: Insights from a 44-Year Industry Veteran

Modular projects involve manufacturing, transportation, and on-site assembly. Developers must understand exactly what they are responsible for versus what they subcontract. Risk advisors should research the developer’s contractors, subcontractors, and design-build consultants—especially the modular manufacturer.