Modular Construction Reports & Industry Analysis

The Modular Building Institute gathers and distributes statistical information about the size and growth of the modular building industry analysis. These reports have become the leading source of information on the industry and are used worldwide by investment firms, banks, the media, researchers, consultants, and students.

Contents include General Industry Descriptions, Floors Shipped, Gross Sales, Sales by Market Segment, Dealer Gross Revenue, Lease Fleet Composition, Sale of Used Units, Industry Manufacturing Data, Industry Estimates, and Visuals of Contemporary Modular Buildings. Written in a concise fact-filled manner, these reports are full of interesting and helpful information.

2025 Modular Construction Industry Reports

The Modular Building Institute's 2025 Modular Construction Industry Reports are now available! Get the latest and best available information and data showing modular industry trends, growth instigators, and best practices for permanent modular construction and relocatable buildings across North America.

Not a member of the Modular Building Institute? That's okay! Our industry-leading modular industry reports are FREE.

Don't miss out—this data isn't available anywhere else!

U.S. Permanent Modular Construction Industry Report

2025 UNITED STATES PERMANENT MODULAR CONSTRUCTION INDUSTRY REPORT

This comprehensive analysis, developed in collaboration with FMI Consulting, focuses on the economic performance, trends, and forecasts for permanent modular construction in the United States. The report reflects updated methodologies, enhanced regional analysis, and robust data from both primary and secondary sources.

Highlights include:

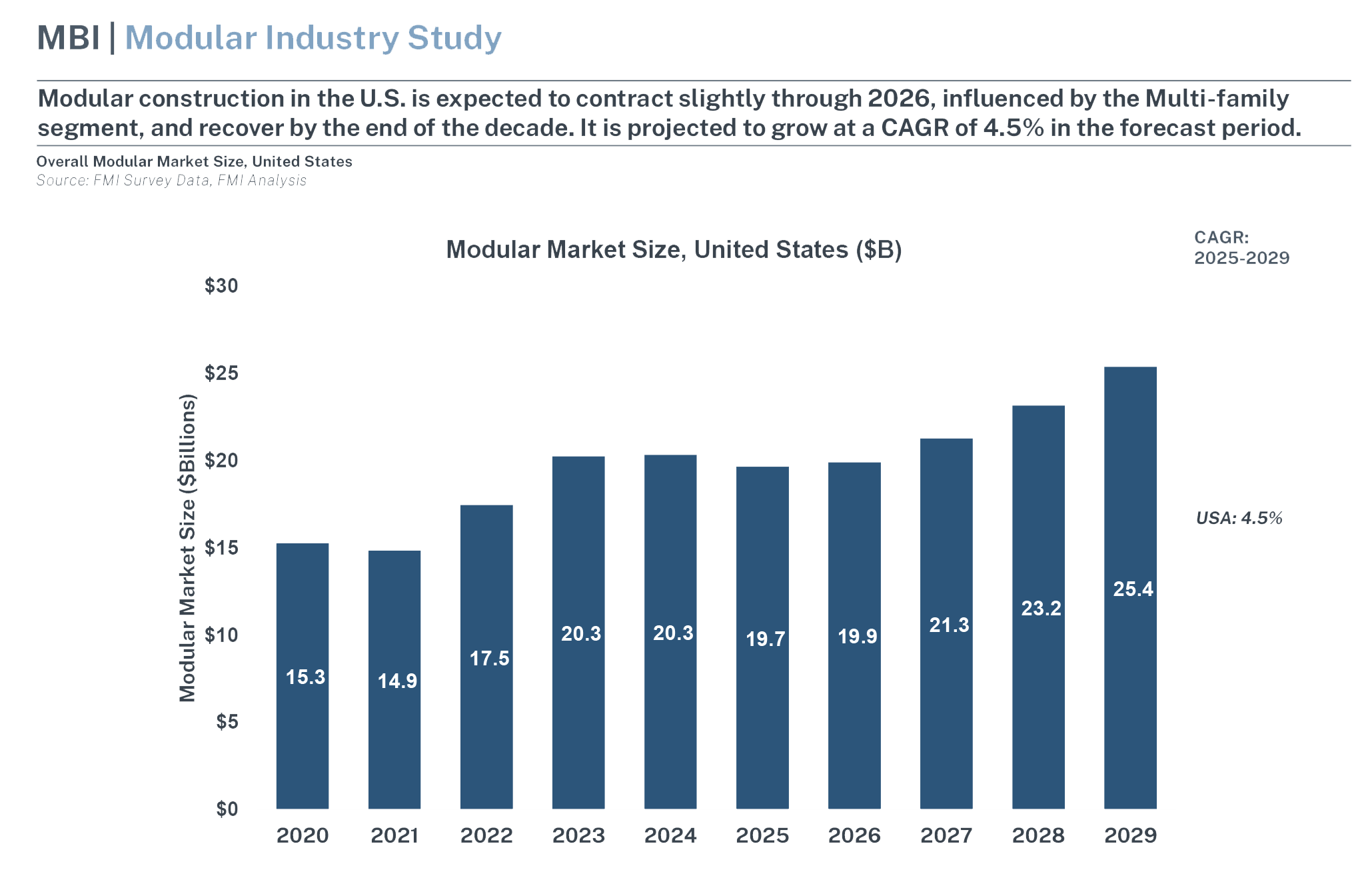

Market Size and Growth

In 2024, the U.S. modular construction market reached $20.3 billion, accounting for 5.1 percent of total construction activity across key segments. Forecasts indicate a compound annual growth rate (CAGR) of 4.5 percent, with the market expected to reach $25.4 billion by 2029— outpacing the broader construction industry by 1.3 percent.

Key market segments driving growth include:

- Multifamily residential ($7.1B in 2024 → $11.3B in 2029; 4.7 percent CAGR)

- Office/data centers ($1.4B → $2.0B in 2029; 7.1 percent CAGR)

- Lodging ($577M → $1.1B in 2029; 9.2 percent CAGR)

Regional Insights

The U.S. modular market is growing across all regions, with varying demand dynamics:

- West ($7.5B in 2024): The leading region, especially in California, driven by high housing demand and strong tech/data center investments (4.9 percent CAGR).

- Northeast ($4.5B): Dense urban markets like New York and Boston, regulatory complexity, but high adoption in education and housing sectors (4.7 percent CAGR).

- South ($4.4B): The most populous and fastest growing region, with opportunities in lodging, pad retail, and housing (4.4 percent CAGR).

- Midwest ($4.0B): Slower growth but niche opportunities in education, rural healthcare, and manufacturing (3.8 percent CAGR).

Strategic Implications

Speed to market (81 percent) and cost efficiency (68 percent) are top drivers for adoption, particularly when modular designs are standardized. Labor availability (52 percent) continues to reinforce offsite construction as a viable solution to skilled-labor shortages. However, increased investment in awareness, policy advocacy, and factory capacity is essential to scaling adoption.

Relocatable Buildings Report

2025 RELOCATABLE BUILDINGS INDUSTRY IN NORTH AMERICA REPORT

The relocatable buildings industry in North America continues to play a crucial role in providing temporary and flexible space solutions for sectors like education, construction, healthcare, and disaster relief. The Modular Building Institute, representing more than 700 members globally, leads efforts in promoting professionalism, innovation, and growth in the modular construction sector.

Highlights include:

Markets Size and Economic Impact

- Total fleet size: ~500,000 units in North America (300,000 units private/200,000 public)

- Industry assets: More than $8 billion

- 2024 capital investment: ~$800 million in new purchases and improvements

- Employment: 10,000-plus direct jobs and thousands more indirectly supported

- 2024 total revenue: $4.7 billion, with:

○ 40 percent from rentals (units and value-added products)

○ 27 percent from new unit sales

○ 23 percent from services

○ 10 percent from used unit sales

Utilization and Financial Performance

- 2024 midyear utilization: 69.2 percent

- 2024 year-end utilization: 68.9 percent

- Despite a slight dip in the utilization rate, revenues grew by 7.9 percent due to rising rental rates.

Key Markets and Applications

Top sectors include:

- Education (34 percent)

- Construction offices (23 percent)

- General offices (17 percent)

- Workforce housing/energy (13 percent)

- Others include healthcare, retail, and disaster relief.

Canadian Modular Industry Report

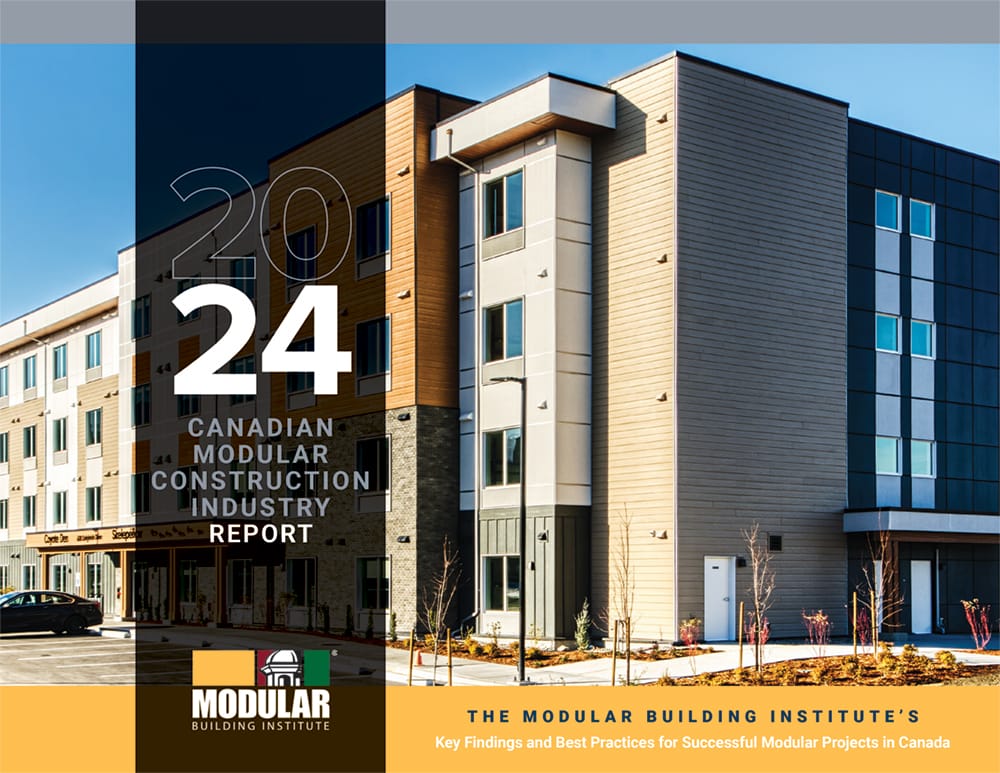

2025 CANADIAN MODULAR CONSTRUCTION INDUSTRY REPORT

In spring 2025, the Modular Building Institute and FMI Consulting began a collaborative effort to provide current, detailed, and actionable market insights. The outcome of that partnership, this report is intended to provide a means to measure and monitor changes across the industry, specifically describing five-year historical (2020-2024) and five-year forecast (2025-2029) data for volumes of modular Construction Put in Place (CPiP).

Highlights include:

2024 Market Size

The Canadian modular construction market was valued at $5.1 billion Canadian dollars (CAD), representing 7.5 percent of the overall Canadian construction market.

2025-2029 Forecast

Modular construction in Canada is expected to grow at a CAGR of 5 percent through the forecast period, reaching approximately $6.4 billion CAD by 2029, driven primarily by the lodging, education, and multifamily segments.

Regional Split

Eastern Canada currently leads the Canadian modular construction market in terms of both volume and growth rate, driven by high-density housing needs and public investment in education. Western Canada, while smaller, shows potential particularly in lodging, remote housing, and industrial-supportive infrastructure, and benefits from a slightly faster historic growth trajectory.

- Eastern Canada (New Brunswick, Newfoundland and Labrador, Nova Scotia, Ontario, Price Edward Island, Quebec): $2.8B in 2024, 5.2 percent CAGR through 2029

- Western Canada (Alberta, British Columbia, Manitoba, Saskatchewan, Northwest Territories): $2.3B in 2024, 4.9 percent CAGR through 2029

While Eastern Canada has higher overall modular volumes, Western Canada has had a higher growth rate since 2020. Through the end of the forecast period, growth rates for the regions are projected to be nearly equal.

Segment-Specific Highlights

Nearly half of the projected modular market size in Canada will be in the multifamily sector. Multifamily also has the highest projected CAGR, at 7.4 percent, driven by growing populations in the major metro areas.

Eastern Canada is expected to see strong urban-driven demand, especially in Ontario and Quebec. Western Canada (notably British Columbia and Alberta) is also poised for growth, with similar housing pressures. Key drivers here are the housing affordability crisis and urban migration.

Past Industry Reports

Looking for additional data? MBI's 2024, 2023, 2022, and 2021 reports are available below. For older modular construction reports, contact us.

Permanent Modular Construction Reports

Permanent Modular Construction (PMC) is an innovative, sustainable construction delivery method utilizing offsite, lean manufacturing techniques to prefabricate single or multi-story whole building solutions in deliverable module sections. PMC modules can be integrated into site built projects or stand alone as a turn-key solution and can be delivered with MEP, fixtures and interior finishes in less time—with less waste, and higher quality control compared to projects utilizing only site-built construction. Recent research on modular building construction analysis has come out supporting the fact that modular construction is an efficient construction process and poised to help the construction industry grow.

Relocatable Buildings Reports

A Relocatable Building (RB) is a partially or completely assembled building that complies with applicable codes or state regulations and is constructed in a building manufacturing facility using a modular construction process. Relocatable buildings are designed to be reused or repurposed multiple times and transported to different building sites. They are utilized for schools, construction site offices, medical clinics, sales centers, and in any application where a relocatable building can meet a temporary space need. These buildings offer fast delivery, ease of relocation, low-cost reconfiguration, accelerated depreciation schedules and enormous flexibility. Relocatable buildings are not permanently affixed to real estate but are installed in accordance with manufacturer’s installation guidelines and local code requirements. These buildings are essential in cases where speed, temporary space, and the ability to relocate are necessary.

Canadian Commercial Modular Construction Reports

Note: Canadian industry reports are not available for 2023 and 2022.